Financial institutions love Cashy

.png)

.png)

.svg)

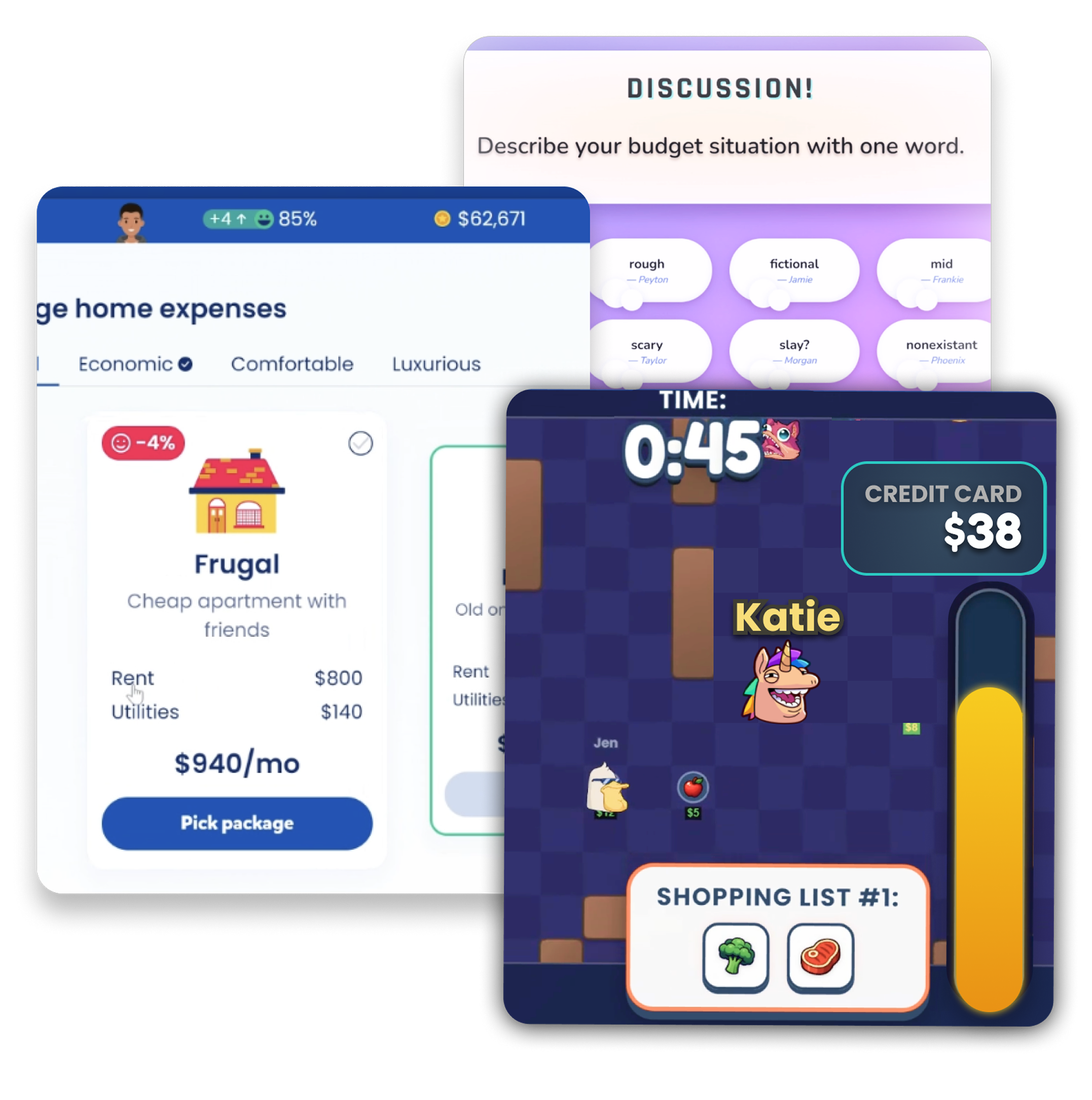

No more boring lectures and slideshows

Make your workshops fun and interactive

Cashy turns workshops into game-based experiences where participants play, compete and discuss.

Games and presentations for any topic and audience

From credit to fraud and kids to adults, use Cashy in all of your workshops.

100% plug-and-play, zero prep needed

Just choose a game or presentation and launch in seconds. Players can join on any device

.png)

Never run out of things to say

See discussion topics, speaker notes, and game activity to always add fun commentary and get the audience talking.

Built for financial institutions

How Cashy was born

I wanted something hands-on and fun. So I built a prototype.

When I tested it in class, students were literally jumping from their chairs, cheering and high-fiving their friends. I realized Cashy could make financial education fun around the world.

Today, over 200,000 students have learned with Cashy. Next milestone: one million!

Frequently Asked Questions

Is the platform customized to our branding?

Yes!

How long does the games and presentations last?

They’re flexible and can be run as short 5-minute icebreakers or for hours-long workshops, depending on what the facilitator needs.

What ages and audiences does Cashy work for?

Cashy works for middle school, high school, college students, and adults. It’s used in classrooms, community events, branches, and online webinars.

What if my audience members don't have devices?

Cashy works on any device, but in rare circumstances when audience members don’t have any device, you can host games and presentations only on your device.

Is Cashy available in Spanish or another language?

Yes! Cashy can be used in Spanish and supports browser-based translation for many other languages.

How does it work technically?

Facilitators launch a game or presentation, and participants join using a link or code, no downloads required.

Have more questions?

Make Financial Education Fun

Try Cashy Classroom for free and see how much students will love you and your institution.

.png)

%20(1)%20(1).png)

.avif)

.avif)

.avif)

.avif)